Advertisement

Modern financial services are evolving under the direction of advanced artificial intelligence. Banks, lenders, and insurance firms use AI daily. AI enables faster, smarter, safer, and more efficient working. It examines vast volumes of data in minutes. It identifies trends, points out hazards, and even projects future behavior. One of its key functions is fraud detection. It can instantly identify questionable activities and notify the business straight away.

Artificial intelligence also enhances consumer service using virtual assistants and chatbots. Creating clever portfolios even helps control investments. AI speeds up daily tasks and lowers human errors through automation. Real-time updates also help companies move quickly. Globally, financial services are starting to include artificial intelligence rather heavily.

Modern financial services benefit greatly from artificial intelligence since it speeds up and smartly handles daily chores. Reviewing loan applications, credit ratings, spending patterns, and other financial data quickly can also help lenders decide faster and more wisely. Additionally, virtual assistants and chatbots that constantly answer consumer questions are driven by artificial intelligence. People are not waiting long for help nowadays.

Robo-advisors in investment management create clever portfolios using artificial intelligence. They change with the times without the emotional clouding of judgment. Furthermore, artificial intelligence enables businesses to provide better goods and services. Researching consumer behavior points to customized offerings and solutions. Banks and companies can react fast to changes in the market. AI is also applied to enhance compliance and identify dangerous behavior.

AI has revolutionized financial firms' fight against fraud by accelerating the dependability of detection. Before artificial intelligence, people had to personally verify dubious transactions, which took time and led to errors. AI can now immediately examine millions of transactions and identify anomalous behavior, including weird login attempts or expenditure patterns. Machine learning sharpens artificial intelligence. It picks lessons from past fraud instances and quickly adopts new techniques.

AI can automatically freeze dubious transactions for inspection and score risks. Certain systems even allow one to forecast which clients might turn targets. Early actions safeguard businesses from losses and guard consumers. Artificial intelligence systems never stop working; they are not fatigued either. They move far faster than human teams. AI keeps learning and getting better while fraudsters create fresh methods. Fewer fraud instances and improved general protection for all who follow this.

Real-time monitoring is one of the most effective tools AI offers for fraud protection. Fraud used to be sometimes found too late, following significant damage. AI now sees every transaction as it occurs. It searches for abrupt changes, such as expenditures from far-off areas or particularly large purchases. AI instantly alerts us if it finds something odd. It lets banks immediately stop a transaction or freeze the account.

Early response helps to save money and build client confidence. AI systems also pick up for each client what is normal behavior. AI will verify if the transaction is authentic if unexpected activity outside of usual patterns arises. Faster answers and less loss follow from real-time notifications. These warnings also allow financial firms to examine fresh fraud tendencies and upgrade their systems. Companies using artificial intelligence stay ahead of fraud, not merely respond to it.

AI is not limited to combating fraud. It also manages several daily chores, therefore saving time and reducing mistakes. AI helps financial businesses enter data, update customer accounts, and handle payments. Before artificial intelligence, workers had to put hours into these straightforward but crucial tasks. Automation streamlines regular tasks and lessens human mistakes. AI rapidly checks documentation and matches it to databases during client onboarding. Customers will thus find the sign-up procedure faster and simpler.

In lending, artificial intelligence may check applications, evaluate risk, and propose approval or rejection. It advances fairness and accelerates loan approvals. Insurance companies utilize artificial intelligence to handle claims rapidly using images and reports. By automating these chores, companies save money and free their employees for more critical work. Consumers also appreciate fewer errors and faster service.

Predictive analytics is one of the best ways AI enhances financial services today. It allows businesses to project future results using historical performance. Before a loan default, banks can find consumers who might do so. Insurance companies can find risky consumers and modify their policies. To assist their clients in making wiser decisions, investment firms can forecast industry trends.

Through tracking expenditure behavior, predictive analytics also aids in the early identification of fraud. Based on consumer demands, companies can create improved financial solutions. They can also more successfully create marketing plans. Predicts driven by artificial intelligence enable companies to avoid expensive mistakes and take calculated risks. Better earnings and happier consumers follow from this. Simple data becomes insightful knowledge thanks to predictive analytics. AI prediction-based financial services keep ahead of the competitors.

While artificial intelligence offers many advantages, financial services also face major difficulties when applied. Protecting consumer data is one major problem. Financial firms handle private data with sensitivity. Hence, artificial intelligence systems have to be safe. Any leak may seriously hurt the client as well as the business. AI systems' partiality presents still another issue. AI taught on unfavorable data may make unfair choices. Businesses have to examine and correct any bias closely.

Furthermore, plenty of high-quality data is necessary for AI to function effectively. Bad customer service and erroneous forecasts resulting from inadequate data can follow from this. Managing artificial intelligence systems also calls for knowledgeable people with financial and technological backgrounds. Getting and preparing these professionals might be costly. Establishing and keeping up AI infrastructure also costs money.

These days, advanced artificial intelligence is crucial in financial services. It increases consumer service, efficiency, and detection. Real-time transaction monitoring using artificial intelligence delivers alarms right away. Predictive analytics enhances decision-making and automates repetitive chores. Though data privacy and prejudice are issues, good planning will help to overcome them. Those financial firms that apply artificial intelligence sensibly keep ahead of rivals and challenges. To their clients, they present quicker, safer, and better services. AI technology will become ever more crucial for the direction of finance.

Advertisement

Discover how GLUE and SQuAD benchmarks guide developers in evaluating and improving NLP models for real-world applications

IoT and machine learning integration drive predictive analytics, real-time data insights, optimized operations, and cost savings

Find out why Claude 3.5 Sonnet feels faster, clearer, and more human than other AI models. A refreshing upgrade for writing, coding, and creative work

Nvidia stock is soaring thanks to rising AI demand. Learn why Nvidia leads the AI market and what this means for investors

Still puzzled by self in Python classes? Learn how self connects objects to their attributes and methods, and why it’s a key part of writing clean code

Learn how Automated Machine Learning is transforming the insurance industry with improved efficiency, accuracy, and cost savings

Compare GPUs, TPUs, and NPUs to find the best processors for ML, AI hardware for deep learning, and real-time AI inference chips

Learn about essential AI skills for network professionals to boost careers, improve efficiency, and stay future-ready in tech

AI transforms sales with dynamic pricing, targeted marketing, personalization, inventory management, and customer support

Frustrated with messy data workflows? Learn how dbt brings structure, testing, and version control to your data pipeline without adding extra complexity

Chile uses forest fire detection technology and AI-powered fire warning systems to detect fires early and protect forests

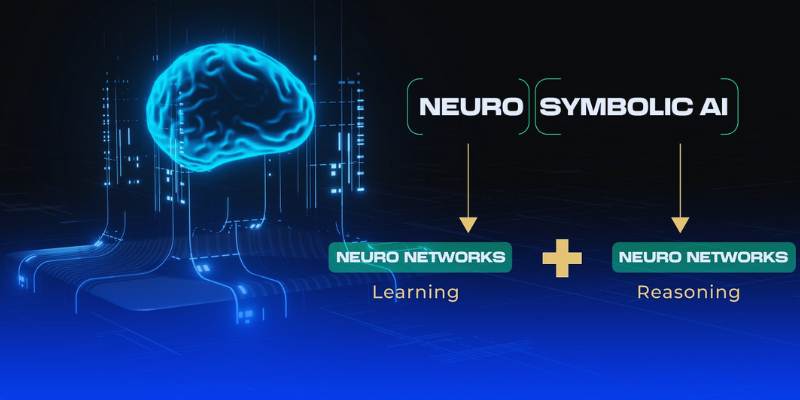

Neuro-symbolic AI blends neural learning and symbolic reasoning to create smarter, adaptable systems for a more efficient future